Burlington, Vt. -- Today, Burlington Mayor Miro Weinberger announced over $44 million in savings for Burlington’s taxpayers, driven by favorable lending terms as a result of the City’s restored Aa3 credit rating. These locked-in savings were shared in Chief Administrative Officer (CAO) Katherine Schad’s Fiscal Health Report, an annual report that the administration has published since it was requested by the City Council in 2013 following the issuance of a $9 million Fiscal Stability Bond that year. The report updates prior savings projections and outlines $24,108,885 in current dollars of savings on debt service. The report outlines an additional $20,566,079 savings on future debt service for the $130 million bond issued for the construction of a new Burlington High School and Technical Center. Together, the total current dollar savings to tax payers and ratepayers is $44,674,964.

"In 2012, we were teetering on a financial cliff, our rainy-day fund was millions of dollars in the red, and Burlington was pockmarked with stalled projects and aging public infrastructure,” said Mayor Miro Weinberger. “After more than a decade of strong and careful management we have locked in millions of taxpayer savings while restoring our cash reserves and making historic levels of public investment into our roads, sidewalks, stormwater system, parks, and City buildings. The City of Burlington is on solid ground and taxpayers will feel the benefits of this dramatic turnaround for years to come.”

In August, Moody’s Investment Service provided its most recent credit opinion, affirming the City’s Aa3 credit rating and citing several credit strengths, including that “Burlington's budget management and policy credibility and effectiveness is strong and is reflected in its healthy financial position and trend of stable operations and reserves.” Further, Moody’s stated that “The city's financial position is likely to remain stable over the next few years because of conservative budgeting and prudent revenue increase.”

"Once again Moody’s has affirmed a stable financial position for the City of Burlington at a double-A rating and we are pleased to report significant taxpayer savings as a result,” said CAO Katherine Schad. “Throughout the pandemic and economic recovery, my office has continued this Administration’s commitment to strict financial management and perpetual improvement of our internal systems. As a result, we are in a strong position to continue high levels of capital investment and we are ready for whatever storms may come in the future.”

Background

- Between 2010 and 2012, the City’s credit rating was downgraded six steps in three separate actions by Moody’s, from a high of Aa3 to a low of Baa3 (one step from junk bond status), citing the Burlington Telecom liability and advances to other enterprise funds; increasing reliance on short-term borrowing; and multiple years of operating deficits.

- In FY12 the Management Letter from the City’s auditor stated the City was “at risk” due to being “overly reliant on borrowing from financial institutions to provide overall City short-term cash requirements.”

- In FY13, in response, the Mayor and City Council received voter approval to issue $9 million in Fiscal Stability Bonds in 2013. The bond proceeds resulted in an immediate improvement of the City’s cash situation and eliminated costly short-term borrowing.

- Since FY13, the City has seen four credit rating upgrades for a total of a six-notch improvement with the most recent upgrade to Aa3 being achieved in July 2019. Moody’s August 2023 credit opinion updated the rating agency’s analysis supporting this rating.

- The improved score leads to lower interest rates and more preferable borrowing terms, saving tax payers money.

- In its most recent round of significant borrowing earlier in September, the City secured a 3.84% interest rate for $130 million in school construction bonding, resulting in net present value savings of $20,566,079 on future debt service payments versus what the cost would have been if the City’s credit rating was still Baa3.

Restoring the Unassigned Fund Balance

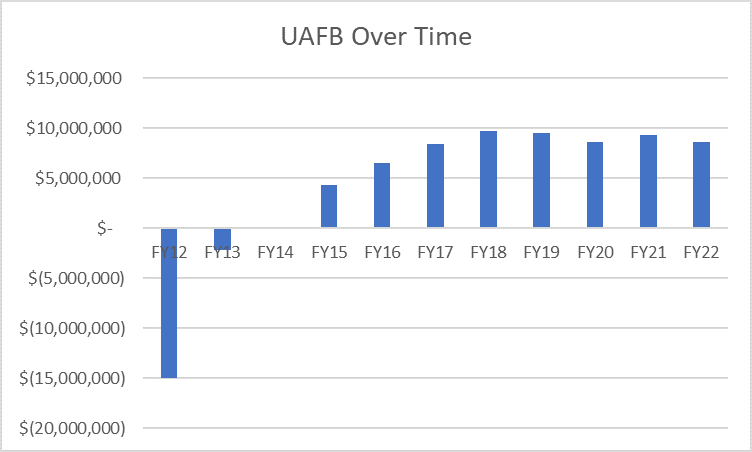

Critical to restoring Burlington’s positive credit score has been the dramatic improvement to the Unassigned Fund Balance (UAFB), also known as the rainy-day fund, which provides cash reserves used to maintain essential public services during crisis.

- In FY12 the City had a more than $15 million deficit in the UAFB, primarily driven by the uncollectible Burlington Telecom receivable, and carried more than $23 million in cash deficits across numerous general and enterprise funds.

- The first step to stabilize the situation was the $9 million in Fiscal Stability Bonds, and in FY13 the City saw its first positive UAFB since 2009.

- The Administration and leadership team worked hard over many years to focus on fiscal management, including by implementing a new UAFB policy in FY15, which commits the City to a UAFB of 5 – 15% of the General Fund budget’s operational costs.

- As a result, the UAFB was converted to a surplus of $9.7 million by the end of FY18 and has remained well within the target range despite the COVID crisis.

More Information:

The CAO’s fiscal health report is available online here.

The August Moody’s credit opinion is available online here.

###